Why do Americans have so much medical debt?

There are several reasons why Americans have so much medical debt. One reason is that the cost of healthcare in the United States is very high. According to the Kaiser Family Foundation, the average American family spent $28,166 on healthcare in 2020. This is much higher than what people in other developed countries spend on healthcare.

Another reason why Americans have so much medical debt is that many Americans have high-deductible health insurance plans. These plans have a low monthly premium, but they have a high deductible, which is the amount of money that the insured person must pay out-of-pocket before their insurance starts to pay. In 2020, the average deductible for a single person with employer-sponsored health insurance was $1,463, and the average deductible for a family was $4,595.

What are the consequences of medical debt?

Medical debt has negative consequences for Americans. One consequence is that it can damage credit scores. This can make it difficult to qualify for loans and other financial products, such as a mortgage or car loan. Medical debt can also lead to bankruptcy. In 2020, medical debt was a factor in 58% of all bankruptcies.

Another consequence of medical debt is that it can lead to financial hardship for Americans. Many people who have medical debt are forced to cut back on other expenses to pay their medical bills. This can lead to stress and anxiety, and it can also have a negative impact on physical health.

What can be done to address the problem of medical debt?

There are a number of things that can be done to address the problem of medical debt. One thing is to make healthcare more affordable. This could be done by lowering the cost of health insurance premiums and deductibles, or by expanding government programs such as Medicare and Medicaid.

Another thing that can be done to address the problem of medical debt is to help people who are already struggling to pay their medical bills. This could be done by providing financial assistance programs, or by making it easier for people to negotiate, or enter into affordable payment arrangements with their healthcare providers. From a healthcare provider perspective, it is imperative to ensure the revenue cycle is efficient, and easy to navigate for consumers. Providing omni channel communication options, simplified self-service options and up-front financial services can reduce consumer apprehension and improve patient satisfaction.

References from the Debt.com report “Many Americans Can’t Afford Less than $5,000 in Medical Debt”.

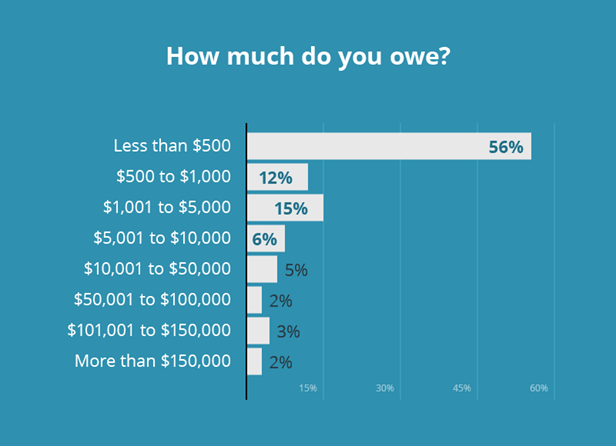

- 41% of Americans have medical debt.

- The average medical debt per person is $6,600.

- 20% of Americans have medical debt that is over $10,000.

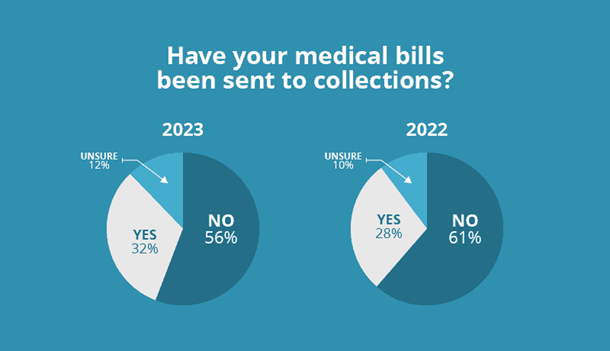

- Medical debt is the most common type of debt in collections.

- Medical debt can have a negative impact on credit scores, making it difficult to qualify for loans and other financial products.

- Medical debt can also lead to bankruptcy.

Conclusion

Medical debt is a serious problem in the United States. It can have several negative consequences for Americans, including financial hardship, damage to credit scores, and bankruptcy. From a healthcare provider standpoint, various things can be done to help patients, including ensuring thorough screening for Financial Assistance eligibility and only pursuing collections against patients who have the ability to make payments but choose not to.